Will AMD stock price catch up to Nvidia's?

ON THIS PAGE: Will AMD stock price catch up to Nvidia's?

- Recent events, on the other hand, could push the stock higher. The fight between AMD vs Nvidia are always down the corner.

- NVIDIA vs Intel

- Is AMD's stock capable of matching NVIDIA's?

Recent events, on the other hand, could push the stock higher. The fight between AMD vs Nvidia are always down the corner.[ps2id id='Recent events, on the other hand, could push the stock higher. The fight between AMD vs Nvidia are always down the corner.' target=''/]

For Advanced Micro Devices shareholders, the year 2020 has been a disappointment (AMD). Year-to-date, the stock is down more than 14%. Of course, if you had bought the stock five years earlier, you might have made a nearly 2,200 percent profit.

Is that kind of development possible in the future, or has this stock already run its course?

Any analysts assume that if Intel (INTCleadership )'s changes, the firm will face heightened rivalry. New innovations from NVIDIA Corporation could be of greater interest (NVDA).

Yes, there are fair claims to be made that AMD's period of fast growth is coming to an end; nevertheless, AMD's recent performances, as well as innovations that might push the stock higher, provide counterpoints.

NVIDIA vs Intel[ps2id id='NVIDIA vs Intel' target=''/]

AMD's success can be traced in large part to Intel's mistakes.

Intel reported a failure in the unveiling of the 7nm method after years of delays in implementing its 10-nanometer (NM) process technology.

Because of the delays, Advanced Micro Devices (NASDAQ:AMD) has been able to capture a greater share of the CPU business by integrating novel designs with Taiwan Semiconductor's (NYSE:TSM) process technology. The graph below shows AMD's progress over the past few years.

Some fear that Intel's latest CEO, Pat Gelsinger, could lead to renewed rivalry.

While that may be so, investors may rest assured that NVIDIA is currently posing a challenge to AMD's development.

The Grace CPU chip was released by NVDA last month. Grace, according to the firm, can provide ten times the existing output for artificial intelligence and high-performance computing servers. Furthermore, NVIDIA's graphics processing units were winning market share prior to the release of Grace.

NVIDIA is also in talks with SoftBank to buy ARM Limited (OTCPK:SFTBY). If the transaction goes through, the business will gain a greater share of the data centre industry. Last month, though, the UK tried to scuttle the agreement, citing national security issues as a reason. As a result, a Citi analyst estimated that the chances of approval were 10%.

AMD vs. NVDA: Recent Results

AMD's first-quarter earnings for 2021 were released fewer than two weeks ago. Revenues increased by 93 percent year on year, gross profit increased by 94 percent, net profits increased by 243 percent, and EPS increased by 221 percent. NVIDIA released a statement in late February. Revenues increased by 61 percent year on year, while gross profit dropped by 1.8 percent, net profits increased by 53 percent, and earnings per share increased by 51 percent. AMD clearly outperformed the competition in any division.

In terms of sales, NVDA had somewhat more than $5 billion to less than $3.5 billion for AMD.

The next quarter's income is expected to increase by 86 percent year over year, according to AMD management. Revenue is expected to increase by 50% over the course of the year.

NVIDIA's management predicted $5.3 billion in sales for the next year, but the firm reported in mid-April that strong demand made it possible that it will surpass that amount.

Direct comparisons between AMD and NVDA

AMD's currency, assets, and short-term deposits total just over $3.1 billion. Long-term debt totals $313 million for the firm.

NVDA's currency, equivalents, and short-term deposits total $11.56 billion. Long-term debt totals approximately $6 billion for the group.

I don't think either company has a significant financial edge over the other because both have solid financial foundations.

For both firms, the accompanying graph shows a number of data representing analysts' average two-year growth rate.

Author's chart based on Metrics Seeking Alpha

AMD outperforms NVDA in any metric when it comes to expected development.

AMD has the upper hand.

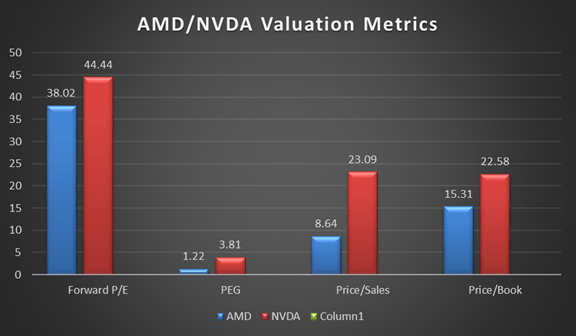

The graph below shows a number of valuation metrics.

Metrics is the source of this information. Author's Chart on Yahoo Finance

AMD seems to be more attractive than NVDA in any way, and sometimes by a large margin. From my view, the 3 to 5 year PEG is especially revealing.

AMD has the upper hand.

Stock prices for AMD and NVDA

AMD's stock is reportedly trading at $77.87. The average price expectation over the next 12 months is $97.24, according to 30 analysts. Since the last quarterly update, the average price objective of the four analysts rating the stock has risen to $114.50, a 47 percent boost.

NVIDIA is now trading at $571.63. The average price expectation for the next 12 months is $607.74, according to 33 analysts. Since the last quarterly update, the average price objective of the four analysts rating the company has risen by 10.5 percent to $631.56.

AMD has the upper hand.

Is AMD's stock capable of matching NVIDIA's?[ps2id id='Is AMD's stock capable of matching NVIDIA's?' target=''/]

My title asks a rhetorical query, not a rhetorical question. While AMD's stock will have to increase by 730 percent to match NVIDIA's current share price, keep in mind that AMD's stock has increased by well over 2,000 percent in the last five years.

Since the business is rising too quickly, management is having trouble getting reliable advice. Prior sales growth projections of 37% in 2021 have been updated to represent a 50% revenue boost this fiscal year.

Demand for AMD's EESC segment is expected to rise by 86 percent in the second quarter alone. Consider that the EESC segment expanded at a staggering 286 percent YoY last year, bringing in approximately a billion dollars more than the previous year.

Increased demand for the company's Ryzen CPUs is also contributing to the company's development, thanks to a strong PC sector. Simultaneously, an increase in laptop demand has resulted in six straight quarters of high sales growth for mobile processors.

Add on the possibility that the boom in computing demand is projected to grow. In 2021, IDC predicts an 18.2 percent increase in global PC shipments.

According to JP Morgan analyst Harlan Sur, AMD has an 8% to 9% share of the x86 server CPU segment. For the next two years, he expects the firm to capture 2% to 4% of the industry, according to his projections.

Furthermore, shipments of the company's high-margin Radeon 6000 graphics cards doubled from the previous year. Additional growth could come from that source in the coming quarters, as output of those GPUs ramps up.

The market for data centre graphics cards rose in the third quarter, and the upcoming release of a new generation of data centre accelerators is anticipated to keep the trend going.

In addition, the global data chip demand is expected to expand at a 9.4% CAGR through 2025.

Allied Market Research is the source for this information.

Last but not least, AMD is scheduled to complete the purchase of Xilinx (XLNX) later this year. This agreement would boost AMD's total revenue by a third and improve its position in the data centre chip industry.

So, in response to the query raised by the article title, I believe AMD has a chance to equal NVIDIA's current share price.

Is AMD Stock a Good Investment?

Readers should be aware that I am a firm believer in key value investing. However, I've found over the years that current P/E isn't necessarily a good indicator of value. AMD has outstanding development opportunities in the short to medium term. Secular developments in a number of industries could aid expansion, the business has a strong financial base, and the purchase of Xilinx would accelerate the company's already rapid growth.

The forward P/E of 38x, which I consider fair for a stock with AMD's growth prospects, as well as the 3 to 5 year PEG of 1.22 in a market with a forward PEG of 2.00, are also important factors in my assessment.

As a result, I recommend AMD to buyers who are able to take on the possibility of high-growth stocks.

https://www.techguruhub.net/2021/05/06/will-amd-stock-price-catch-nvidia/?feed_id=85689&_unique_id=62a78763b200c

Comments

Post a Comment